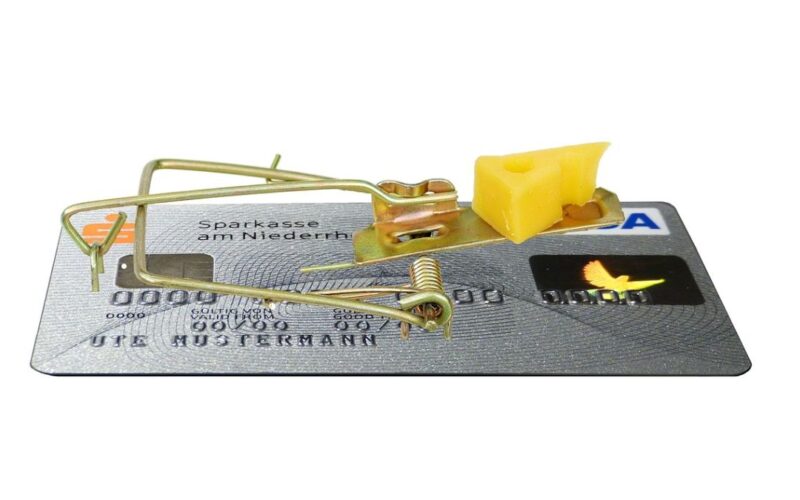

In the modern era of electronic transactions and cashless payments, credit cards have become an integral part of our financial landscape. While they offer convenience and flexibility, there’s a potential pitfall—falling into a credit card trap. This article serves as an essential guide, providing insights and strategies on how to navigate the credit card landscape safely, making smart financial choices to avoid unnecessary debt.

Understanding the Credit Card Trap

Instant Gratification

Credit cards offer the allure of instant gratification, allowing users to make purchases without immediate cash outlay. This convenience, however, can lead to impulsive spending and a disconnect from the reality of the funds being spent.

Minimum Payment Misconception

The trap often begins when users opt for minimum payments, assuming it’s a manageable way to handle debt. In reality, this approach results in accumulating interest over time, making it harder to break free from the credit card cycle.

Strategies to Avoid the Credit Card Trap

Educate Yourself

The cornerstone of avoiding a credit card trap is financial literacy. Understand the terms and conditions of your credit card, including interest rates, fees, and penalties. Familiarize yourself with the impact of minimum payments and the importance of timely payments.

Budgeting Mastery

Create a comprehensive budget that aligns with your income and financial goals. Categorize expenses and allocate funds responsibly. A well-structured budget helps in distinguishing between necessary and discretionary spending, preventing unnecessary credit card usage.

Responsible Credit Card Management

Critical Evaluation of Purchases

Before using your credit card, critically evaluate the necessity of the purchase. Ask yourself if it’s a need or a want. This mindful approach helps in curbing impulsive spending and ensures that credit is used responsibly.

Emergency Fund Creation

Building an emergency fund acts as a safety net, reducing reliance on credit cards during unexpected financial challenges. Having a financial cushion minimizes the risk of falling into the credit card trap when unforeseen expenses arise.

Mindful Credit Card Usage

Set Reminders

Late payments contribute significantly to credit card debt. Set reminders for payment due dates to avoid unnecessary fees and interest charges. Timely payments not only maintain a positive credit history but also reduce the risk of falling into a debt spiral.

Full Payment Practice

Where possible, aim to pay the full balance each month. This practice not only prevents interest accumulation but also instills financial discipline. If paying the full amount is challenging, prioritize paying more than the minimum to expedite debt repayment.

Credit Card Evaluation

Regularly Check Statements

Frequent monitoring of credit card statements allows you to track spending patterns and detect any unauthorized transactions promptly. This proactive approach ensures financial security and prevents the accumulation of unnoticed debt.

Evaluate Rewards Programs

Many credit cards offer rewards programs, but these can sometimes lead to overspending to earn rewards. Evaluate whether the benefits outweigh the potential drawbacks and adjust your usage accordingly.

Debt Repayment Strategies

Debt Snowball Approach

For those with multiple credit card debts, consider the debt snowball method. Pay off the smallest debt first, gaining momentum and motivation. Then, proceed to the next smallest debt, gradually eliminating each balance.

Debt Avalanche Technique

Alternatively, employ the debt avalanche technique by focusing on the debt with the highest interest rate first. This method minimizes interest accumulation over time, potentially saving money in the long run.

Professional Guidance

Credit Counseling Agencies

If credit card debt becomes overwhelming, seek guidance from reputable credit counseling agencies. Professionals can provide personalized advice, negotiate with creditors, and help formulate a realistic debt repayment plan.

Debt Consolidation Consideration

Debt consolidation might be an option for individuals juggling multiple credit card debts. However, it’s crucial to assess the terms and ensure that it genuinely alleviates financial strain rather than exacerbating it.

Financial Empowerment and Responsibility

Navigating the credit card landscape requires a combination of financial literacy, responsible spending, and proactive debt management. By understanding the potential pitfalls and implementing strategies to avoid the credit card trap, individuals can use credit cards as a tool for financial convenience rather than succumbing to a cycle of debt.

Ultimately, financial empowerment comes from making informed choices, practicing mindful spending, and cultivating responsible credit card habits. With these strategies in place, individuals can confidently navigate the credit card landscape, making financial decisions that align with their long-term goals and securing a stable and debt-free financial future.